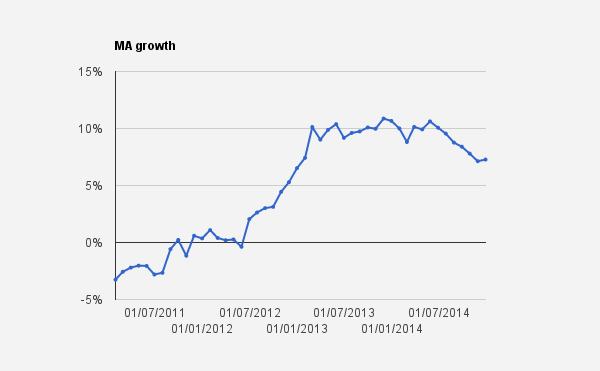

I am busy revising the paper that explains the theory behind MA, and have recently updated the measure. As the chart shows, the growth rate has tailed off significantly in recent months.

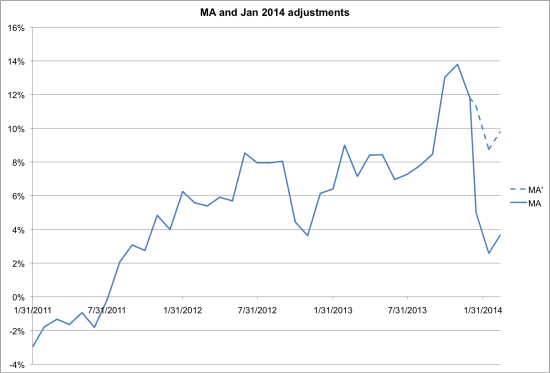

The reason for the drop is a massive reduction UK resident MFI sterling sight deposits that occured in January 2014. Here's a closer look at that series:

The reason for the drop is a massive reduction UK resident MFI sterling sight deposits that occured in January 2014. Here's a closer look at that series:

The Bank of England have the following note:

The Bank of England have the following note:

Due to improvements in reporting at one institution, the amounts outstanding decreased by £85bn. This effect has been adjusted out of the flows for January 2014.

To show the impact of this "improvement in reporting" I've created MA' which adds £85bn from January 2014. As you can see this explains the sharp fall:

MA' remains in double digit growth. A downside of relatively narrow measures of the money supply is that they are less robust when it comes to these types of ad hoc adjustments. But clearly more details need to be revealed about the precise nature of this change.