Following the fourth meeting of Kaleidic Economics, we have released a report on the UK's austerity plans. Three main arguments are made:

- Temporary changes in the tax code are inconsistent with both sides of the debate

- We cannot ignore the historic state of the UK economy when discussing fiscal policy

- Alternative forecasts for GDP can make a dramatic difference to austerity measures

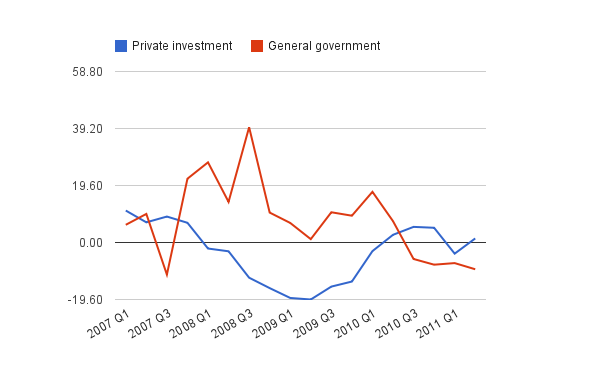

This chart shows government spending as a proportion of GDP, using a GDP forecast lower than the official OBR figures. It reveals that government plans to reduce spending are based as much on over optimistic growth forecasts as they are on actual spending cuts.

You can read it in full here (.pdf).