Last night I participated in an ASI Webinar on NGDP targeting. You can rewatch it here.

I was flattered to appear alongside the Scott Sumner, ‘The blogger who saved the economy”, and enjoyed the event. I thought I’d post my notes here.

What is an NGDP target?

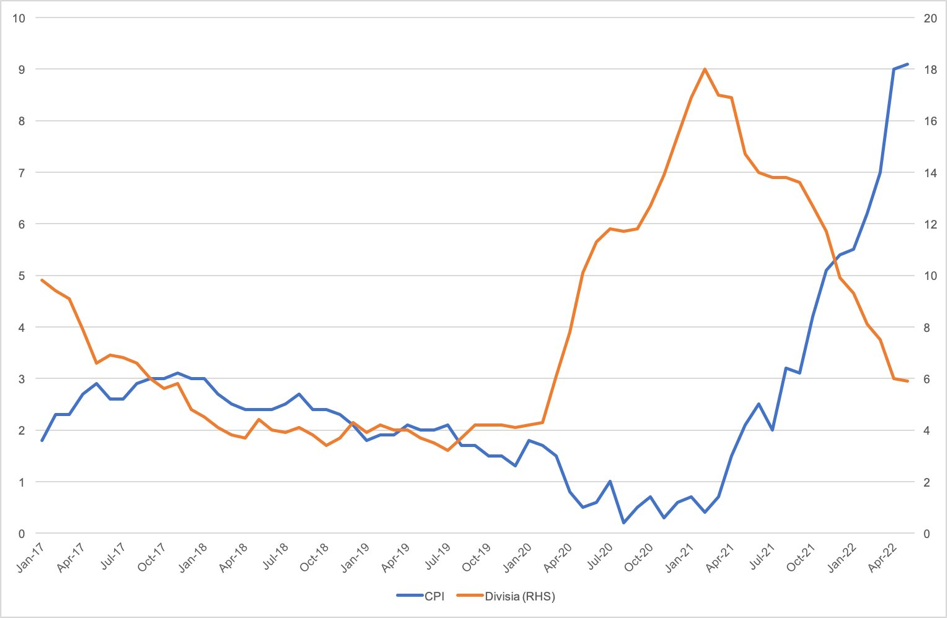

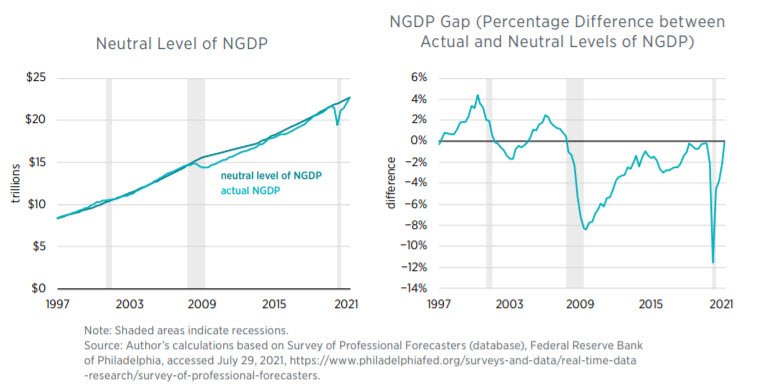

Instead of being bound by a money growth rule or an inflation target, the central bank conducts monetary policy to hit a specified rate of nominal income. This aims to create a stable environment for wage and debt contracts, which are more important for economic planning than stability around consumer prices. It would allow inflation to rise when real growth is low, and potentially for prices to fall when productivity is strong.

How can NGDP targets fit within a free market approach to monetary policy?

Some would argue that having a central bank that undertakes monetary policy is fundamentality incompatible with a “free market” approach. But given that we have a central bank it’s reasonable to try to reduce the harm that it can do. And it’s potential harm works in two directions: (i) excessive inflation (and in some cases hyperinflation); and (ii) allowing expected nominal incomes growth to collapse (as happened in 2008).

Not only do I believe that an explicit NGDP target would improve central bank performance, it moves us closer to a free market solution.

It’s neutral - NGDP stability is a means to delivery monetary equilibrium, which occurs when the supply of money adjusts to changes in the demand for real balances. (In terms of the equation of exchange, it’s desirable for changes in V to be offset by changes in M such that PY remains stable. Indeed this is what would occur in a “free banking” regime, without a central bank). Monetary equilibrium will move interest rates toward the “natural” rate, which is where the demand and supply of loanable funds is in equilibrium, and ensure an efficient allocation of resources.

It’s limiting - If tied to open market operations (OMO) you can strip away a lot of central bank activity that’s distortionary, and this limits the central bank to it’s only legitimate role, which is managing the supply of that which it has a monopoly over.

It’s rule-based - If tied to market expectations (e.g. by setting up an NGDP futures market) you eliminate any discretionary decision making by central banks, reducing the epistemic burden of monetary policy.

How has the Bank of England responded to the global financial crisis, Eurozone sovereign debt crisis, and covid-19 pandemic?

Their response has been wedded to a failed approach to monetary policy. The Bank of England pioneered “One Target One Tool'“ and have historically been committed to a very simple framework where they use interest rates to target inflation. In addition to adopting QE in 2009, the Bank have utilised a range of ad hoc tools but with no stated objective or clearly communicated exit strategy. They have also been inconsistent on whether they have an inflation target (e.g. aim for 2% inflation in 2 years time) or a price level target (e.g. aim for 2% inflation, on average, over a certain time horizon). They’ve introduced unemployment as a threshold for forward guidance and there’s even a claim that by “seeing through” inflation when real growth is low, they have an implicit NGDP target. Either way, it’s long overdue that they adopt a new approach.

Is now the right time for NGDP targets?

2008 showed NGDP targets in all their glory - a negative supply shock prompted inflation to rise and central banks responded with tight monetary policy (the ECB famously increased interest rates to 4.3% in July 2008. You can’t really blame them for that, however, because they were following their commitment to an inflation target). This is the classic situation where inflation targets and NGDP targets have different implications for monetary policy, and NGDP targets are superior.

Initially I interpreted the coronavirus pandemic as a supply shock, and therefore thought that NGDP targets may have another moment of focus. However it’s increasingly obvious to me that we haven’t had a negative supply shock at all - there’s no fall in capacity and the labour force is largely undamaged. Rather, it’s been a very odd type of demand shock. We haven’t seen a fall in people’s desire to spend money per se, but we have seen a state mandated reduction in economic activity, which amounts to the same thing. (It isn’t really a Keynesian collapse in confidence, but technically it constitutes a fall in people’s desire to spend money, or, equivalently, a rise in people’s desire to hold money). Hence we’ve seen large increases in the savings rate, household deposits, and repayment of consumer credit. (Indeed this is why many are optimistic about the recovery - normally in a recession there’s a case for government to “kick start” spending with a fiscal stimulus, but the fiscal multiplier is irrelevant now. All that’s needed is permission to spend).

Given that we’re facing a demand shock, which puts downward pressure on inflation, there’s less necessity for an NGDP target. It wouldn’t imply a different policy response than the existing inflation target. So I don’t see a reason for much appetite for an NGDP target right now, and won’t hold my breath. That said, I believe an NGDP target is even more relevant than in 2008, for three key reasons:

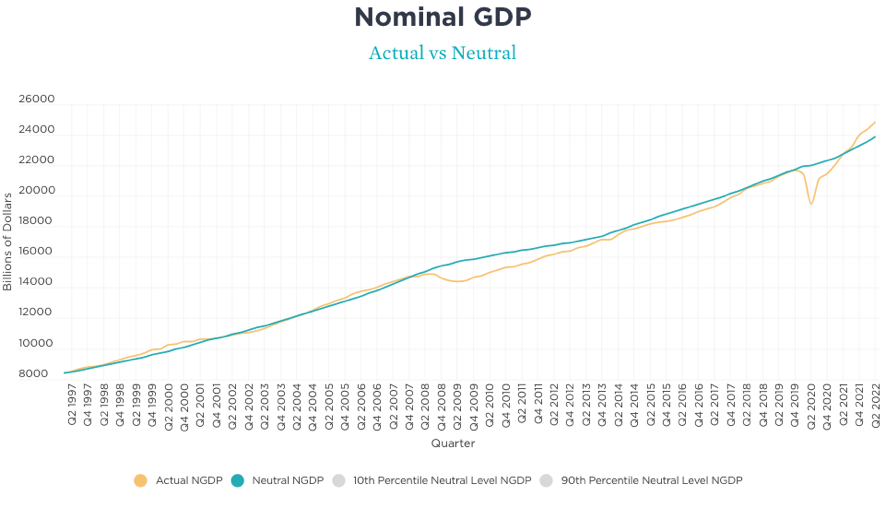

CPI data is faulty - we know that the current “basket” of goods used to measure inflation won’t reflect the huge changes in consumption patterns that have taken place due to lockdown. The large drop in transactions and impact of legislative restrictions on things like price gouging mean that central bankers will be taking CPI data with a large pinch of salt.

Better suited to ensuring financial stability, which is of increasing concern - the counter cyclical inflation caused by NGDP targets cause real debt burdens to change in a pro-cyclical manner, and shares the losses with the creditor. This is good.

We already do it (sort of) - some argue that prior to 2007 there was an implicit 5% NGDP target being adopted. It isn’t a massive jump to make the output part of any “dual mandate” more explicit, and uniting it with the inflation target to create a simple, combined focal point.

Ultimately I believe we’re long overdue an end to “emergency” monetary policy, and now’s as good a time as ever to move to an NGDP target.

What are the downsides of an NGDP target?

It relies on GDP data which is slow to be released and subject to revision. Some argue that overly tight policy in 2008 was more due to faulty GDP data than a commitment to an inflation target, and you don’t want monetary policy hampered by large revisions to past data.

The “total income stream” doesn’t care whether spending is captured within GDP so there may be better measures to target. You could opt for something narrower (e.g. consumption of final goods) or broader (e.g. total transactions). Ultimately though I believe that all macro indicators have limitations, and right now GDP figures are no worse than the CPI basket. And there’s a trade off to be made in terms of how well known GDP is and understood by the public. I’m monitoring Average Weekly Earnings as a key indicator for the UK, but I’m not ready to abandon GDP is our key macro indicator just yet.

Leads to greater inflation volatility, and it was a hard fought battle to create independent central banks that see fighting inflation as their primary aim. We don’t want to return to a time when inflation is highly volatile. And yet adopting an NGDP target would, I believe, continue to keep inflation expectations well anchored. As we’ve seen since 2008 inflation can swing quite widely above and below target when we fail to achieve macro stability. An NGDP target would bring greater stability and ensure that although inflation does more “work”, it operates within a reasonable range.

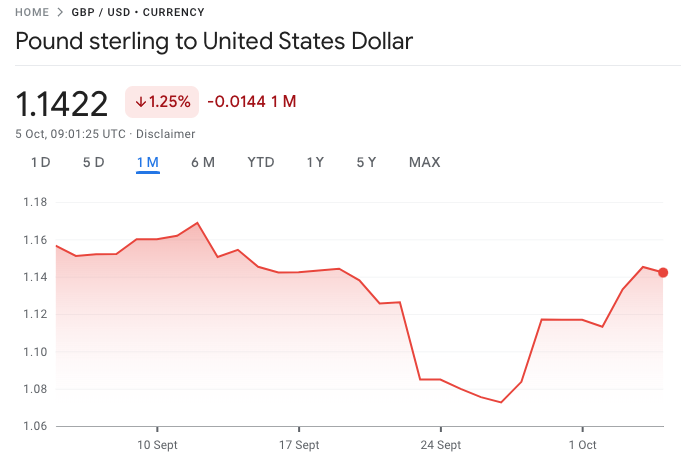

It doesn’t work for all countries - for small, open economies that are reliant on single commodities an NGDP target isn’t suitable. For such countries I’d recommend other monetary policy regimes - e.g. a currency board, or fixing to an alternative nominal anchor. But I think an NGDP target works well for large industrialised countries with independent, credible central banks.

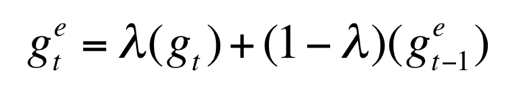

In my proposal for an NGDP target, published as “Sound Money”, I advocated a 2% average growth of NGDP expectations over a 5 year rolling period.

I note that in Scott Sumner’s latest paper, published yesterday, he advocates the following:

the Government should provide the Bank of England’s monetary policy committee a remit to:

target a nominal GDP growth of around 4% per annum over the coming years;

use “level targeting,” which means making up for past undershoots or overshoots — in practice, this would mean compensating for lower nominal GDP growth in 2020 by targeting a higher nominal GDP growth rate in 2021; and

have the central bank target market expectations of nominal GDP growth.

Also yesterday, the former Chancellor Sajid Javid included the following recommendation in his report on restoring growth post covid:

Astute watchers will have noticed that David Beckworth was originally supposed to participate, but unfortunately he wasn’t able to join the webinar. Fortunately though he’s produced this timely analysis of NGDP Targeting in the UK.

So yesterday was a big day for NGDP targets in the UK. Let’s hope the momentum builds!